Master in FinTech: Finance Digital Transformation

- ONLINE

- 60 ECTS

- 7700€

- OPEN CALL

- 12 MONTHS

- SPANISH

The Master in FinTech: Finance Digital Transformation equips you with the necessary knowledge to lead the strategies and process of digital transformation in financial institutions. Understand the role of new technologies in the financial sphere and learn how to launch companies in the market aimed at offering financial products and services that improve the consumer experience thanks to technology.

Master in FinTech: Finance Digital Transformation (Spanish)

Universitat de Barcelona

Get a double degree from our academic partner, the reference university in Catalonia and Spain with more than 560 years of history behind it.

QS Stars Rating System

We are the first 100% online Business School in the world to receive the QS Stars rating, obtaining the highest distinction, five QS Stars, in the Online Learning.

AEFI

OBS is a partner of the Spanish FinTech & InsurTech Association (AEFI), the institution dedicated to defending the common interests of companies in both sectors.

Syllabus of the Master in FinTech: Finance Digital Transformation

Our programme is structured in 2 blocks and culminates with the Master's Thesis. In addition, two voluntary bootcamps and different additional activities will be carried out during the programme.

Block 1. FinTech management and development.

Block 2. Technologies and tools within the reach of finance.

Master's Final Project

Bootcamps and additional activities

1. FinTech management and development

One of the key differentiating factors of FinTech is the offer of alternative financial products/services to the traditional ones, making use of the new technologies offered by the market, for which it is necessary to have knowledge of market research, which allows for the detection of new consumer needs. Thus, this module provides the knowledge and tools necessary for students to carry out a market research process that allows them to detect existing trends in the FinTech environment, as well as to respond to the needs and demands of the new digital consumer, adjusting the services provided to the needs of the market. Some of the topics that will be covered are: phases of market research, the new digital consumer, quantitative research techniques and qualitative research techniques.

Professor: David Fernández Álvarez, Director at Caixabank Nex.

VIEW LINKEDIN

Adequately defining the strategy, both in a FinTech company and in a traditional financial institution, through the integration of the different technologies, is necessary as it sets the path for the achievement of the objectives. This subject delves into the field of strategic planning, offering a framework that allows the student to adequately define the financial strategy, integrating new technologies, and evaluating the option of developing new services and/or products if necessary. Some of the topics that will be covered are: strategy, strategic planning of the financial department, and strategy and technology.

Professor: Julio Ois Lourenzo, Director for banking and financial services at The Cocktail (WPP Group).

VIEW LINKEDIN

FinTech companies are born as an alternative to traditional financial services, providing greater accessibility and flexibility to consumers, as they are shaped by the digitalisation of traditional financial services/products. This is why it is necessary that every individual who becomes part of this field knows and is familiar with the basic concepts of finance. Thus, this module lays the foundations of finance, so that students acquire the necessary knowledge that will allow them to understand, throughout the programme, the impact of new technologies in this field. Some of the topics covered in this module are: the financial system, investment, financing and the new FinTech environment.

Professor: Lexuri Elorriaga Lekue, Ex CFO at Credit Suisse España.

VIEW LINKEDIN

Properly coordinating all the resources, phases and processes of a FinTech project in order to achieve the objectives and estimated results is the key to success. In this subject the necessary concepts are worked on and the key competences are developed to enable the appropriate leadership and management of FinTech projects. Some of the topics that will be covered are: project management phases, technology project management and project management methodologies.

Professor: Paula Cordero Moreno, Head of learning at BBVA Technology.

VIEW LINKEDIN

2. Technologies and tools within the reach of finance

In financial products/services configured through the use of new technologies, and based on web or mobile applications, it is necessary to have a good UX/UI design that favours user-platform interaction. This module covers the knowledge, skills and tools necessary for UX, UI and interaction design in products and/or services developed based on new financial technologies. Some of the topics that will be covered are: UX design, UI design and interaction design.

Professor: Gustavo Rojas Pávez, Co-Founder -Future & Customer Experience at Personas Design.

VIEW LINKEDIN

The use of different technologies favours the generation of large volumes of data, which correctly managed and analysed, allow relevant information to be obtained about the users of digital products/services, helping in decision-making. This subject explores in depth the analysis and decision making based on data, while highlighting the importance of data within FinTech companies. Some of the topics covered in this module are: the importance of data in FinTech, Big Data, data analysis and data-driven decision making.

Professor: Gema Caballero Muñoz, Big Data & Business Intelligence Project Leader at Engie.

VIEW LINKEDIN

The use of Blockchain technologies in operations or transactions carried out on the network is necessary to guarantee their reliability, as well as to verify the digital identity of users. Throughout this module, the student will learn about the key concepts related to Blockchain, while analysing the impact of these technologies in the current financial sphere, delving into their specific applications. Some of the topics covered in this module are: introduction to Blockchain, cryptocurrencies, digital identity, smart contracts and Blockchain applications in finance.

Professor: Lucas Menéndez Sánchez, Back End Developer en Vocdoni.

VIEW LINKEDIN

Artificial intelligence and its multiple applications has become a key technology in the financial field, as it allows it to solve problems iteratively and learn from them, just as a human being would do. This course delves into the basic concepts of artificial intelligence and the impact it has on technology-based financial companies, as well as the different applications it can have. Some of the topics that will be covered are: fundamentals of artificial intelligence, machine learning and neural networks and AI applications for financial institutions.

Professor: Raúl Melgosa, Head of Analytics & Smart Automation at Generali en Generali.

VIEW LINKEDIN

The use of new technologies as an alternative to traditional products/services in the financial sector is not exclusive to FinTech but has begun to extend to other segments such as insurance, wealth or the legal field. This module offers students a transversal vision of the new technologies that have been incorporated into the financial sector, focusing on the new segments, as well as the benefits derived from their implementation. Some of the topics covered in this module are: technologies available to the financial sector, InsurTech, WealthTech, RecTech and the new digital consumer.

Professor: Blanca Galletero Piqueras, Founder at SanchezGalletero.

VIEW LINKEDIN

There are many other essential technologies in the FinTech field that guarantee, among other things, the security of shared information, such as cybersecurity. This subject introduces students to these technologies, focusing on their impact and implementation in financial institutions or FinTech companies. Some of the topics covered in this module are: data security, cybersecurity, cloud computing technologies and other key technologies in the financial sector.

Professor: Blanca Drake Rodríguez-Casanova, CVC & Strategic Proyects at Wayra Telefónica.

VIEW LINKEDIN

Master's Final Project and Additional Activities

This programme is designed to complement the content of the thematic blocks with the necessary training to achieve their internalisation. The training is conceived from a threefold perspective: technical assistance, personal support and individual and group challenges that are necessary to achieve the objectives set.

Pre-Masters Bootcamps

The student will have the opportunity to take 3 Pre-Master Bootcamps that will be opened progressively and can be taken at any time. Once the course has been completed and passed, a certificate of completion will be awarded.

- Bootcamp 1. Personal Branding

- Bootcamp 2. Data Storytelling

- Bootcamp 3. Creative thinking and innovation

- Bootcamp 4. Generative AI: Prompt Engineering

In addition, students will also have the opportunity to take these pre-master courses; however, these are available in English only:

- Building Your Professional Brand for Employability and Career Success

- Finance Fundamentals

- Organizational Well-Being

Introductory workshop | Campus Training

Before the start of the academic year, students will have the opportunity to attend an introductory workshop on the Campus where they will be provided with the tools and knowledge necessary for the correct use of the platform during the academic year.

Professional Development Programme (PDP)

Two weeks before the start of the academic year, students will be able to participate in a professional development programme where they will work hand in hand with a teacher to develop different skills such as time management, productivity and stress management and emotional intelligence. Upon completion of the workshop, and provided that the relevant activities have been carried out, a certificate of completion can be obtained.

During 6 months students will participate in the elaboration of a proposal for the development and implementation of different technologies in the financial field. A professor will supervise their work. The work must be presented before an examining board.

The Lifelong Learning Master's in Digital Transformation of Finance is complemented by lectures and seminars given in each of the blocks. These additional activities are carried out by renowned professionals in business management who, through videoconferences, present their experiences and case studies.

Bootcamp: FinTech Design

This bootcamp has a 100% practical focus and is developed transversally throughout the different modules. The objective is to work hand in hand with the student in the design of a FinTech project, from market research to the analysis of the feasibility of the implementation of different technologies.

Professor: Penélope Fernández Calle, Head of Digital Customer Manager at WiZink.

VIEW LINKEDIN

Bootcamp: Leadership and change management

This bootcamp helps students to work on leadership and change management skills, from a theoretical and practical perspective. These skills are necessary and essential in a constantly changing financial environment, where the implementation of different technologies becomes necessary in response to an increasingly demanding consumer profile.

Professor: Penélope Fernández Calle, Head of Digital Customer Manager at WiZink.

VIEW LINKEDIN

Company visits

During the course of the programme, students will have the opportunity to attend synchronous videoconferences with professional experts in the programme area. They will share their experience and provide best practices in the sector.

Webinars

Most of the training is done asynchronously, that is, the exchange of knowledge is done through a platform that allows sharing written texts without the need for people to be connected at the same time. Additionally, in each of the modules, synchronous sessions or 'webinars' are organised, where all participants are connected at the same time through an application, which allows the exchange of knowledge in 'real time'.

Students taking the FinTech: Finance Digital Transformation will have the opportunity to prepare for the following certifications*:

• Certificación Scrum Master & Product Owner

• Certificación Scrum Master@Scale

• Certificación Product Owner@ Scale

• Certificación Value Stream Management

*The cost of the certifications, as well as the preparatory courses, is not included in the price of the programme.

Methodology

OBS has an online methodology where the core is the student. Always backed by active and internationally renowned lecturers, who share their knowledge to enhance the professional development of students through a flexible, collaborative method with personalised monitoring. The aim is to create a unique educational experience that allows the assimilation of knowledge in a practical way.

Student ON's fundamental pillar is the student and, for this reason, throughout the course students have their Programme Manager, an academic figure who accompanies them in a personalised way.

Diploma

After successfully finishing the Master's degree, and having completed the relevant procedures, you will receive the Master's degree from OBS Business School. In addition, and provided that you meet the established academic and administrative requirements, you will obtain a Lifelong learning Master's degree from the Universitat de Barcelona (UB).

In order to obtain it, you must have a university degree. In the exceptional case of not having this degree and having passed the Master's evaluations, you will obtain a Higher University Diploma from the Universitat de Barcelona (UB).

At OBS Business School we are committed to having our own degree, which allows us to quickly update and adapt the programmes in each edition to be at the forefront of the educational level demanded by companies today. Our programmes are designed for professionals who want to strenghten their management skills and learn through an international experience.

Admission Process

The fundamental aim of our admissions process is to ensure the suitability of candidates. All participants should get the most out of this learning experience, through a context in which it is possible to develop long-term relationships with classmates, faculty and alumni.

After completing the application form for one of our programmes, you will receive an e-mail with information about the School and a member of the Admissions Department will contact you to start the admission process.

Once you have successfully passed the personal interview, you must submit all the required documentation to continue the admission process and certify that you meet the requirements of the student profile. After the Admissions Committee, if it is positive, you will be able to register and enrol in the programme you have applied for.

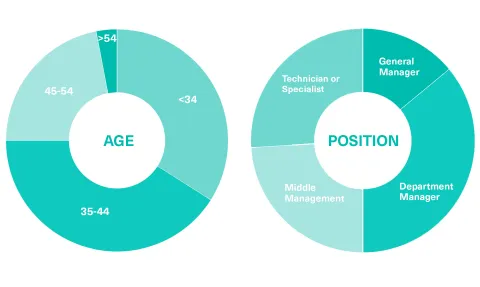

Student Profile

Get to know the profile of our students of the Master in FinTech: Digital Transformation of Finances.

Career opportunities of the Master in FinTech: Digital Transformation of Finances

Our Master in FinTech: Digital Transformation of Finance will allow you to occupy positions such as the following:

- FinTech Project Manager

- Fintech Transformation Manager

- Innovation Manager in Financial Corporations

- Entrepreneurship & FinTech Startups